Amistad Bank provides banking products and services to individuals and businesses. The company offers checking accounts, savings accounts, money market accounts, E-Checking accounts, and individual retirement accounts; and commercial and residential real estate loans, veterans administration loans, federal housing administration loans, family construction loans, refinance loans, home equity loans, home improvement loans, consumer loans, car loans, recreational vehicles loans, special home loans, savings and certificates of deposit secured loans, personal loans, unsecured loans, cash value life insurance loans, commercial loans, accounts receivable loans.

Bank Official Website:

• www.amistadbank.com

Bank Customer Service Telephone:

• 1 (830) 775-0295

Bank Routing Number:

• 111316829

Bank Swift Number:

• This BANK is not part of the SWIFT network, so there is no number.

Online Banking Mobile Apps:

• iPhone

• Android

• iPad

Branch Locator:

•Branch Finder Link

Amistad Bank Online Banking Login

HOW TO LOG IN

Step 1 – Logging in to online banking require the user to go to the bank`s Homepage where they must look for `Internet Banking Login` across the top of the page. Here they must enter their `Access ID` and `Passcode` and then click `Login`.

Forgotten User ID/Password

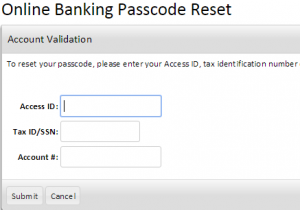

Step 1 – If a user can not remember their passcode they should go to the bank`s homepage and look for a red `Login` button with a `Padlock` symbol at the top right of the page. Next to this is a link `Forgot Passcode` which they should now click on.

Step 2 – The user is now asked to enter their `Access ID`, `Tax ID/Social Security Number` and `Account Number` and then click `Submit`.

Step 2 – The user is now asked to enter their `Access ID`, `Tax ID/Social Security Number` and `Account Number` and then click `Submit`.

If a user can not remember their access ID they can contact the bank by telephone on 1 (830) 775-0295 or they can visit their `Local Branch`.

HOW TO ENROLL

Step 1 – Users wishing to start banking online must go to the bank`s homepage where they need to look for the red `Login` button and `Padlock` symbol at the top right of the page. Next to this is the link `Enroll` which they must click on.

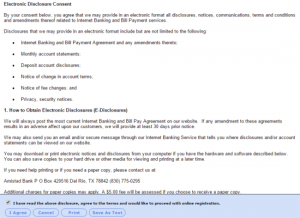

Step 2 – The user is directed to the bank`s electronic disclosure statement for which they must check the box and then click `I Agree` at the bottom of the page to continue.

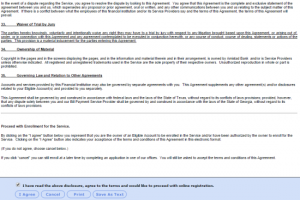

Step 3 – The next page displays the bank`s terms and conditions of use to which the user must again check the box and click `I Agree` at the bottom of the page.

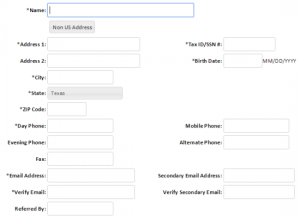

Step 4 – On this page the user is required to complete the `Blank Fields` and then click `Continue`.

Required

- Name

- Address

- ZIP code

- Date of birth

- Tax ID/Social security number

- Daytime telephone number

- Email address